As borders and tax regulations evolve, wealthy individuals and global professionals are increasingly seeking legal and responsible ways to optimize their financial footprint. Beyond travel freedom, second passports are now a core tool for global mobility tax residency planning and long-term tax efficiency.

What Are Second Passport Tax Benefits?

A second passport or alternative citizenship can significantly influence your tax position, depending on the interaction between your home country’s tax laws and the policies of your second citizenship country.

1. Tax Residency Flexibility

One of the most important second passport tax benefits is the ability to choose or change your tax residency. Since tax residency determines how global income is taxed, a second passport provides flexibility to align residency with favorable tax regimes.

- 🔷 Establish residency in low-tax or tax-neutral jurisdictions

- 🔷 Leverage tax treaties to reduce double taxation

- 🔷 Adjust tax status through mobility without changing permanent citizenship

2. No Worldwide Income Tax

Many citizenship-by-investment countries do not tax worldwide income for non-resident citizens. Income earned abroad may remain untaxed by the second passport country, subject to compliance with local rules.

3. Lower or No Capital Gains Tax

Reduced or zero capital gains tax is a major advantage for investors and entrepreneurs operating internationally.

- 🔷 Sale of international assets

- 🔷 Business exits across jurisdictions

- 🔷 Large personal investment portfolios

4. Estate and Inheritance Planning

Some second passport jurisdictions impose no inheritance or estate taxes, allowing families to pass on wealth efficiently when aligned with home-country laws.

How Citizenship Investment Tax Planning Works

Citizenship investment tax planning is a strategic, personalized process that requires coordination across multiple legal systems.

Evaluate your current tax residency

Identify where you currently pay taxes and how your income sources, assets, and lifestyle affect tax exposure.

Research the second passport jurisdiction

Each country defines taxable income, residency, and reporting differently. Understanding these rules is essential.

Integrate local and international tax laws

Work with advisors who understand cross-border taxation to ensure compliance while maximizing efficiency.

Plan for long-term lifestyle and mobility goals

Effective tax planning must support how and where you intend to live, work, and travel over the long term.

Real-World Scenarios of Tax Benefits

Case A: Entrepreneur with Global Business

An entrepreneur from a high-tax country shifts tax residency using a second passport to a jurisdiction with no global income tax, legally reducing taxes on dividends and capital gains.

Case B: Retiree with International Investments

A retiree uses favorable tax rules of a second passport country to minimize double taxation on rental income and simplify estate planning for heirs.

Things to Consider: Risks and Responsibilities

- 🔷 Some nationalities are taxed on worldwide income regardless of residency

- 🔷 Minimum physical presence may be required to maintain tax benefits

- 🔷 Double taxation treaties vary by country

- 🔷 Professional tax and legal advice is essential

Comparison: Tax Impact of Holding a Second Passport vs Single Citizenship

| Aspect | Single Citizenship | Second Passport |

|---|---|---|

| Tax Residency Flexibility | Limited to home country rules | Greater flexibility to choose favorable tax residency |

| Worldwide Income Tax | Often taxed on global income | Possible reduction or exemption with proper residency |

| Capital Gains Tax | Usually applicable | Can be reduced or eliminated |

| Estate & Inheritance Tax | May be high | Often low or zero in some jurisdictions |

| Double Taxation Risk | Higher without treaties | Reduced through treaties and planning |

| Global Mobility | Restricted movement | Enhanced mobility supports tax planning |

| Citizenship Investment Tax Planning | Not applicable | Enables structured long-term wealth planning |

| Compliance Complexity | Single system | More planning, more strategic options |

Frequently Asked Questions (FAQs)

Q1. What are the main second passport tax benefits?

Ans: They include potential freedom from worldwide income tax, reduced capital gains tax, improved estate planning, and greater tax residency flexibility.

Q2. Does getting a second passport automatically change my tax residency?

Ans: No. Tax residency depends on physical presence and legal rules. A second passport expands options but does not automatically alter tax status.

Q3. What is global mobility tax residency?

Ans: It refers to structuring your tax home strategically using mobility and legal residency options supported by citizenship.

Q4. Do all second passport countries offer tax benefits?

Ans: No. Tax systems vary widely. Professional advice is essential before choosing a program.

Q5. Is citizenship investment tax planning legal?

Ans: Yes. When done correctly and transparently, it complies with international tax laws and regulations.

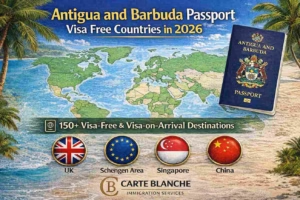

As discussed in the broader trend of tax-efficient second citizenships, St Kitts and Nevis Citizenship and Passport by Investment remains a leading option for international investors due to its no-income-tax structure, asset protection advantages, and global mobility benefits.

ENGLISH

ENGLISH  Arabic

Arabic Persian

Persian